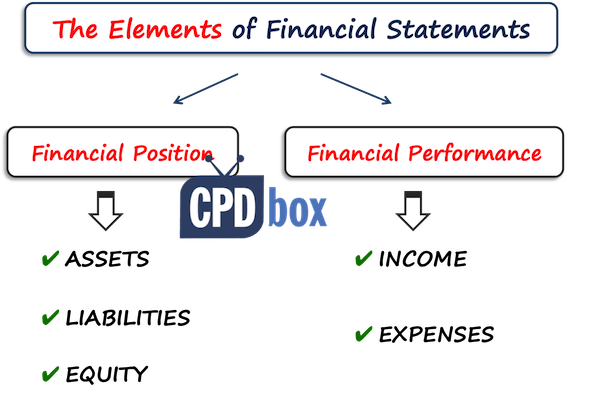

Balance Sheet Definition & Examples Assets = Liabilities + Equity

These and other similarities keep them reliant on each other and make them both essential in providing a clear and complete picture of accounts. Accounts receivable includes all trade receivables, as well as all other types of receivables that should be collected within one year. Marketable securities includes all securities that are held for trading. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. As you can see, the report form is more conducive to reporting an additional column(s) of amounts. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs.

The additional column allows the reader to see how the most recent amounts have changed from an earlier date. After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program. Please review the Program Policies page for more details on refunds and deferrals. We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf. If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction.

Temenos (VTX:TEMN) Has A Pretty Healthy Balance Sheet – Simply Wall St

Temenos (VTX:TEMN) Has A Pretty Healthy Balance Sheet.

Posted: Thu, 17 Aug 2023 04:50:56 GMT [source]

You can also use small business accounting software to auto-create a quick PDF balance sheet based on numbers you input, credit card information, and bank account information. For example, if you have $20,000 in assets and $10,000 in liabilities, then you have $10,000 in stockholder equity. As your company’s total assets grow and liabilities shrink, you’ll have more stockholder equity.

Start your 3-day free trial today!

A balance sheet tells you a business’s worth at a given time, so you can better understand its financial position. Important ratios that use information from a balance sheet can be categorized as liquidity ratios, solvency ratios, financial strength ratios, and activity ratios. Liquidity and solvency ratios show how well a company can pay off its debts and obligations with existing assets. Financial strength ratios, such as the working capital and debt-to-equity ratios, provide information on how well the company can meet its obligations and how the obligations are leveraged.

- We briefly go through commonly found line items under Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity.

- So for the asset side, the accounts are classified typically from most liquid to least liquid.

- In this example, Apple’s total assets of $323.8 billion is segregated towards the top of the report.

- If you are a shareholder of a company or a potential investor, it is important to understand how the balance sheet is structured, how to read one, and the basics of how to analyze it.

- To ensure that your numbers are correct, double check this figure against the company’s general ledger.

A company will be able to quickly assess whether it has borrowed too much money, whether the assets it owns are not liquid enough, or whether it has enough cash on hand to meet current demands. The term Balance Sheet refers to a financial statement that reports a company’s assets, liabilities, and shareholder equity at a specific point in time. Balance sheets provide the basis for computing rates of return for investors and evaluating a company’s capital structure. Building a balance sheet is an important practice that must be conducted on either a quarterly or monthly basis. This financial statement provides insight into your company’s financial health by detailing your assets, liabilities, and shareholders’ equity. A balance sheet is important because it shows business owners and investors what a company owns and owes during a specific period.

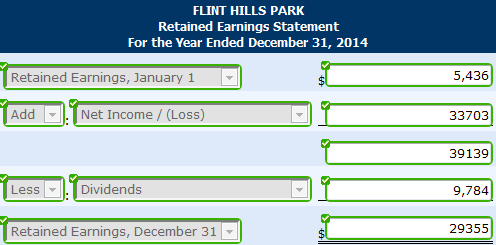

A balance sheet is also always in balance, where the value of the assets equals the combined value of the liabilities and shareholders’ equity. Determine your business’ retained earnings and working capital, as well as the total shareholders’ equity. Retained earnings are the business’ profits which are reserved for reinvestments (not distributed as dividends to shareholders). Shareholders’ equity is the combination of share capital plus retained earnings.

Balance Sheet Templates

The return on assets (ROA) ratio serves as a metric for determining the asset performance of an organization. Over the years, your balance sheet will also include historical data, which can help you—or your lenders or your investors—evaluate your financial strengths and weaknesses, and how they’ve changed over time. If your assets can cover your debts, that’s fine, but it’s not advisable to have too much debt as compared with company assets. The larger the percentage (the debt ratio), the more the company is leveraged. OnDeck has business financing that is tailored for today’s small businesses, with fast access to capital, a streamlined and efficient application process, and service customers rave about. Since 2007, OnDeck has delivered billions of dollars to customers in more than 700 different industries across the United States, Canada, and Australia.

Depending on the company, different parties may be responsible for preparing the balance sheet. For small privately-held businesses, the balance sheet might be prepared by the owner or by a company bookkeeper. For mid-size private firms, they might be prepared internally and then looked over by an external accountant. The image below is an example of a comparative balance sheet of Apple, Inc. This balance sheet compares the financial position of the company as of September 2020 to the financial position of the company from the year prior.

How Do You Read a Balance Sheet?

These things might include short-term assets, such as cash and accounts receivable, inventories, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable to vendors, or long-term liabilities such as bank loans or corporate bonds issued by the company. A statement of financial position, also commonly known as a balance sheet, is a financial report that outlines a company’s assets, liabilities, and shareholders’ equity for a particular period of time. Essentially, a balance sheet provides a picture of what the organization owes and owns for a particular time frame. This is important, as the balance sheet report reflects the organization’s financial status quo. The balance sheet includes information about a company’s assets and liabilities.

Should investors fret over talk of China heading for a ‘balance sheet … – viewpoint.bnpparibas-am.com

Should investors fret over talk of China heading for a ‘balance sheet ….

Posted: Tue, 15 Aug 2023 11:06:08 GMT [source]

If a company is public, public accountants must look over balance sheets and perform external audits. Furthermore, public companies have to prepare their balance sheets by following the GAAP. As you can see, the report form presents the assets at the top of the balance sheet. Beneath the assets are the liabilities followed by stockholders’ equity.

Assets

Balance sheets help with financial planning and give businesses visibility into company assets, liabilities, and owner’s equity. While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment. Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners (owner’s equity). A balance sheet is a type of financial statement used in business and finance to give an overview of a company’s assets, liabilities, and shareholder equity at a given point in time. However, building balance sheets on a quarterly or monthly basis can be a time-consuming process even with accounting software or bookkeeping software. A balance sheet, along with the income and cash flow statement, is an important tool for investors to gain insight into a company and its operations.

The three main accounts of a balance sheet are assets, liabilities, and equity, but there are different accounts within these sections, too. Whether you’re a business owner, employee, or investor, understanding how to read and understand the information in a balance sheet is an essential financial accounting skill to have. Balance sheet substantiation is an important process that is typically carried out on a monthly, quarterly and year-end basis. The results help to drive the regulatory balance sheet reporting obligations of the organization.

It is a snapshot at a single point in time of the company’s accounts—covering its assets, liabilities, and shareholders’ equity. The purpose of a balance sheet is to give interested parties an idea of the company’s financial position, in addition to displaying what the company owns and owes. It is important that all investors know how to use, analyze and read a balance sheet. A company’s balance sheet, also known as a « statement of financial position, » reveals the firm’s assets, liabilities, and owners’ equity (net worth). The balance sheet, together with the income statement and cash flow statement, make up the cornerstone of any company’s financial statements. This balance sheet also reports Apple’s liabilities and equity, each with its own section in the lower half of the report.

Depreciation is calculated and deducted from most of these assets, which represents the economic cost of the asset over its useful life.

This reflects the fact that Walmart is a big-box retailer with its many stores and online fulfillment centers stocked with thousands of items ready for sale. This is matched on the liabilities side by $55.2 billion in accounts payable, likely money owed to the vendors and suppliers of many of those goods. Long-term liabilities are debts and other non-debt financial obligations, which are due after a period of at least one year from the date of the balance sheet. For instance, a company may issue bonds that mature in several years’ time.

- It can be sold at a later date to raise cash or reserved to repel a hostile takeover.

- Fortunately, many places and people are willing to help you learn, including your accountant, your bookkeeper (if you employ one and don’t do the books yourself), as well as the resources at SCORE.

- Shareholder equity is not directly related to a company’s market capitalization.

- For example, in 2021, say a business’ assets increased by $15,000, from $235,000 to $250,000.

- This account may or may not be lumped together with the above account, Current Debt.

- Just as assets are categorized as current or noncurrent, liabilities are categorized as current liabilities or noncurrent liabilities.

All of the above ratios and metrics are covered in detail in CFI’s Financial Analysis Course. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills. Balance sheet substantiation is a key control process in the SOX 404 top-down risk assessment. Balance sheets should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing.

Here are the elements and components of a balance sheet and how they work. For example, if you used an external designer to develop your logo, you could use a market approach to help determine what your logo might sell for in an open market. On the other hand, if your logo is simple text, it may not reach a threshold of creativity to be protected and, therefore, saleable. Typically, people hire a legal team to assess and calculate the value of intangible assets. However, other methods can estimate the value of an intangible asset.

This asset section is broken into current assets and non-current assets, and each of these categories is broken into more specific accounts. A brief review of Apple’s assets shows that their cash on hand decreased, yet their non-current assets increased. Shareholder equity is the money attributable to the owners of a business or its shareholders.

Sexual homones

| Products | Presentations | Positioning |

|---|---|---|

| Drospirenone3mg + EE 0,03mg | 21 o 21+7 tablets | Sales leader (Progestagen of 4th Generation). Anti-mineralocorticoid profile (no weight gains). Minimum side effects (spotting, breast tension). |

| Drospirenone3mg + EE 0,03mg | 24 + 4 tablets | Sales leader (Progestagen of 4th Generation). Anti-mineralocorticoid profile (no weight gains). Minimum side effects (spotting, breast tension). |

| Desogestrel 75 µg | 228 tablets | Progestan only. Suitable for breast-feeding women. Suitable for women with potential risk factors to use COSs. |

| Dienogest 2mg + EE 0,03mg | 21 o 21+7 tablets | Excelent antiandrogenic profile. Peripheral action in ovaries and endometrium. Possible antiacne indication. |

| Chlormadinone 2mg + 0,03mg | 21 o 21+7 tablets | Good antiandrogenic profile. Low side effects. |

| Desogestrel 0,150mg + EE 0,02mg | 21 tablets | Wide range of prescriptions. Good tolerability and low side effects. |

| Desogestrel 0,150mg + EE 0,02mg | 21 tablets | Wide range of prescriptions. Good tolerability and low side effects. |